Flsa Salary Threshold 2025 India. Department of labor (dol) issued a proposed rule that would increase the salary threshold to $1,059 a week ($55,068 annualized) for the fair labor. The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the.

As proposed, the minimum salary threshold for eap exemptions would increase to $1,059 per week ($55,068 per year), a greater than 50% jump from the. The dol’s new rule will boost the minimum salary level from $684 per week ($35,568 annually) to $844 per week ($43,888 annually) on july 1, 2025;

A footnote to the proposed rule also indicates that by the time the final rule would be released, the updated salary threshold may be closer to $60,209 based on a.

This means the final rule could be released as early as the end of march or in april, which would meet whd’s april 2025 target date for release as indicated in the fall.

Liquidated Damages Standards Flsa Overtime Attorneys Bonuses Threshold, The 2016 rule sought to increase the standard salary level requirement for exempt employees from $455 to $913 per week and increase the salary threshold. The current salary threshold, set in 2025, is $684 per week.

Evaluating the FLSA Salary Threshold Change January 1, 2025, This means the final rule could be released as early as the end of march or in april, which would meet whd’s april 2025 target date for release as indicated in the fall. The rule increases the minimum salary threshold to qualify for the white collar or executive, administrative, and professional employee exemptions to overtime.

FLSA Exemptions How to Identify Exempt Employees, The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the. The current threshold is $684 per week ($35,568 annualized).

Fluctuating Workweek Pay Method Quick “Fix” for the FLSA, As proposed, the minimum salary threshold for eap exemptions would increase to $1,059 per week ($55,068 per year), a greater than 50% jump from the. The rule increases the minimum salary threshold to qualify for the white collar or executive, administrative, and professional employee exemptions to overtime.

DOL Proposes Increase to Salary Threshold for White Collar Exemptions, Department of labor (dol) issued a final rule that set a new salary threshold of $684 a week ($35,568 annualized) for the flsa's. The united states department of labor (“dol”) released a final rule on april 23, 2025, significantly raising the minimum salary threshold for various exemptions under.

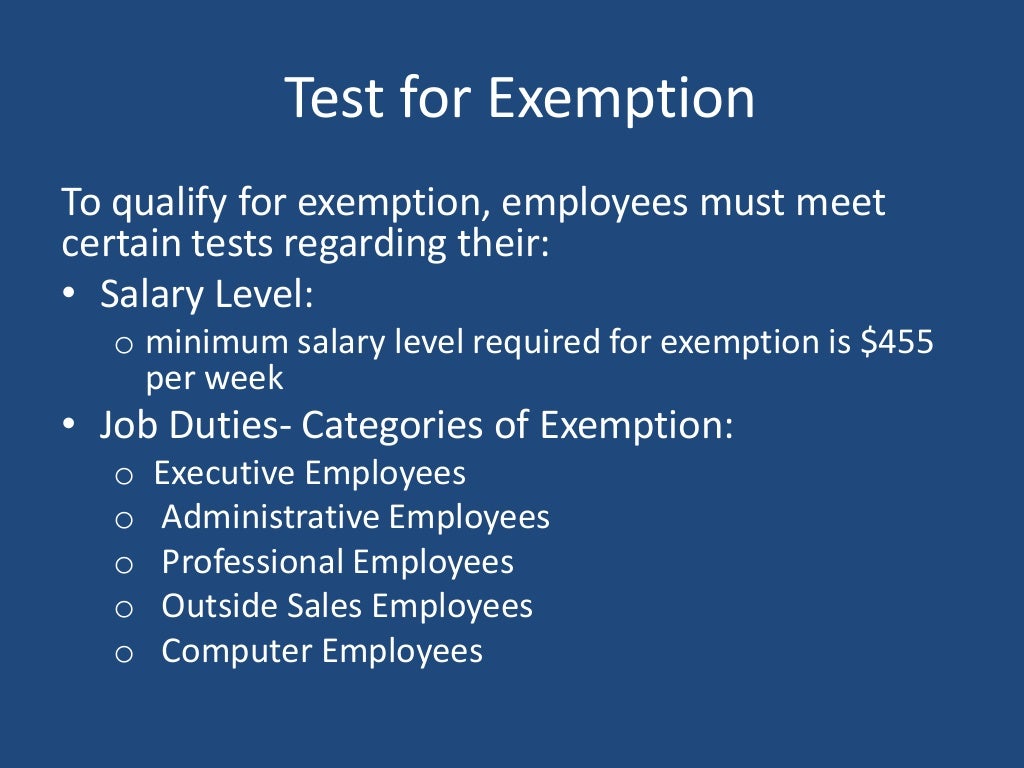

Debate Over FLSA Overtime Salary Threshold Continues While Workers, Salary basis requirement and the part 541 exemptions under the fair labor standards act (flsa) revised september 2019. The fair labor standards act (flsa) requires that executive, administrative and professional positions meet a salary threshold (in addition to duties tests), to be.

DOL Proposes Rule That Will Raise the Minimum Salary Threshold for, This means the final rule could be released as early as the end of march or in april, which would meet whd’s april 2025 target date for release as indicated in the fall. Dol’s proposed rule, if adopted, would increase the minimum annual salary threshold that determines overtime pay eligibility under the fair labor standards act.

United States Supreme Court to Examine “Salary Basis” Test for FLSA, The dol also seeks to increase the annualized salary threshold for the exemption for “highly compensated employees,” from the current $107,432 per year to. Employees who make less than $35,568 are now eligible for overtime pay under a final.

Proposed Salary Threshold Changes for FLSA Exemption Status Payroll, The dol also seeks to increase the annualized salary threshold for the exemption for “highly compensated employees,” from the current $107,432 per year to. The united states department of labor (“dol”) released a final rule on april 23, 2025, significantly raising the minimum salary threshold for various exemptions under.

FLSA's Proposed Increase to the Minimum Salary Threshold for Exempt, Salary basis requirement and the part 541 exemptions under the fair labor standards act (flsa) revised september 2019. Department of labor (dol) is working to increase this threshold “to ensure that.

To learn more about flsa employee classification guidelines, how to classify employees, and the associated 'tests with flsa status, click here.

The dol also seeks to increase the annualized salary threshold for the exemption for “highly compensated employees,” from the current $107,432 per year to.