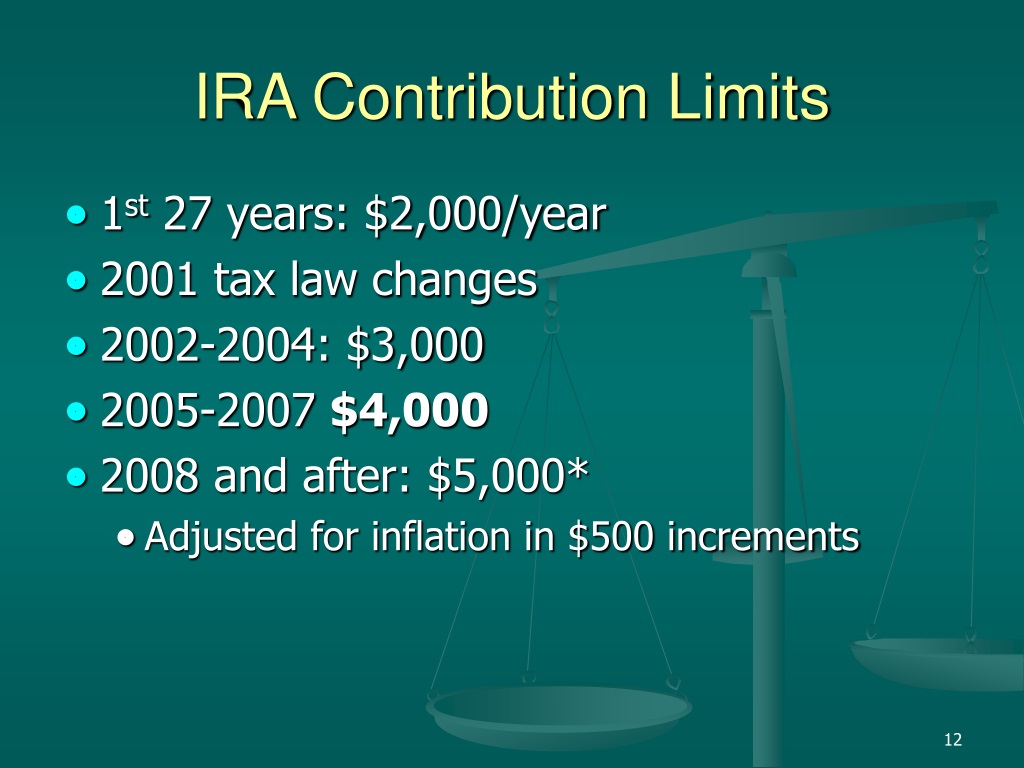

Ira Contribution Limits 2025 Deadline For Employers. The contribution limits for a traditional or roth ira increased last year but remain steady for 2025. The irs sets deadlines and contribution limits for both traditional and roth retirement accounts.

Traditional ira contributions and magi limits (2025) taxpayers who meet the magi. 2025 contribution limits for 401 (k) and similar plans (and 2025):

simple ira contribution limits 2025 Choosing Your Gold IRA, For the current year, you can contribute up to $7,000 to a traditional,.

401k Roth Ira Contribution Limits 2025 Mary Anderson, We break down these limits for tax years 2025 and 2025.

Ira Contributions Limits 2025 Etta Kathrine, The deadline for 2025 ira contributions is april 15, 2025.

Simple Ira Maximum Contributions 2025 Jack Lewis, 28, 2025, they may be required to automatically enroll you starting in 2025.

Sep Ira Contribution Deadline 2025 With Extension Valerie Mackay, Combined, the employee and employer contributions to a 401(k).

Simple Ira Employee Contribution Limits 2025 Alison Jackson, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025.

Ira Contribution Limits 2025 Over 50 Max Kelly, The annual contribution limit for employees who participate in 401(k), 403(b), most 457 plans and the federal government’s thrift savings plan is.

2025 Roth Ira Contribution Limits Married 2025 Kimberly Underwood, Check out how much you can contribute to an ira, who is eligible to contribute, and the deadline to make the 2025 maximum ira contribution in 2025.